Prepared by:

Prepared for:

Flexible Benefits, Increased Tax Savings

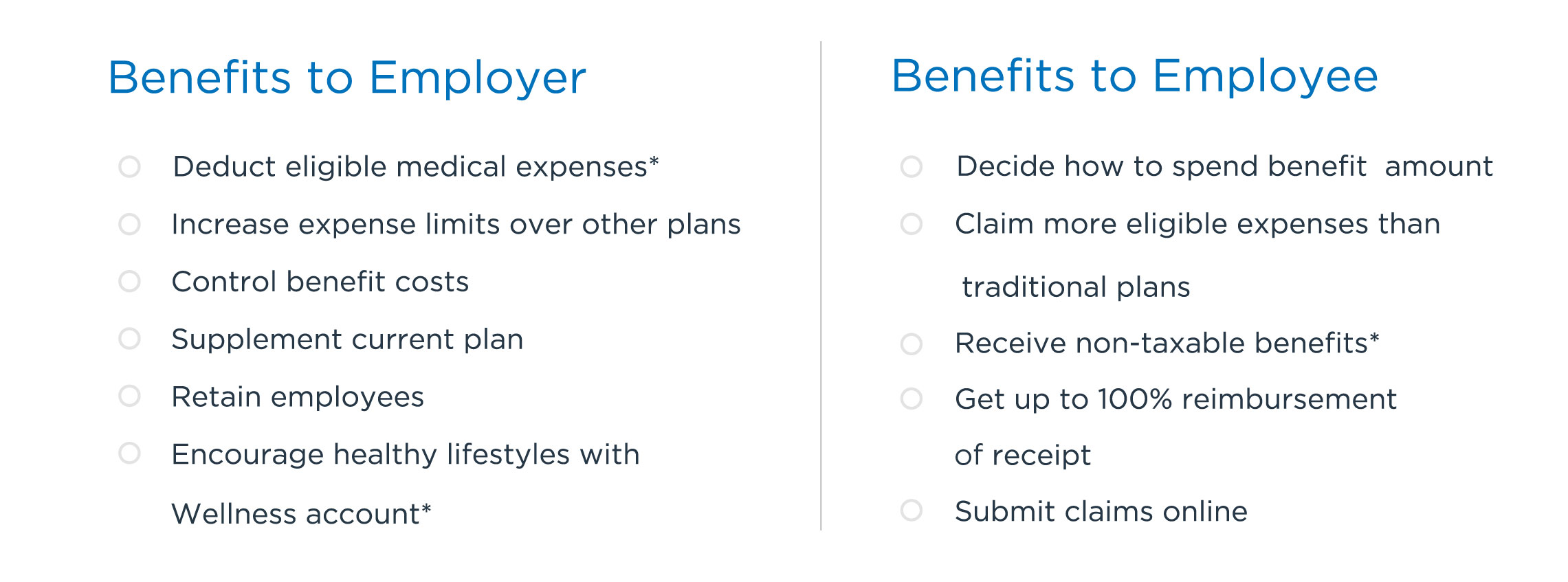

FlexSave is a cost efficient and flexible way to provide medical and dental benefits for you, your employees and their families.

How much will FlexSave cost?

Only pay for what you use. Paid claims and service fee may be

100% tax-deductible to your business.

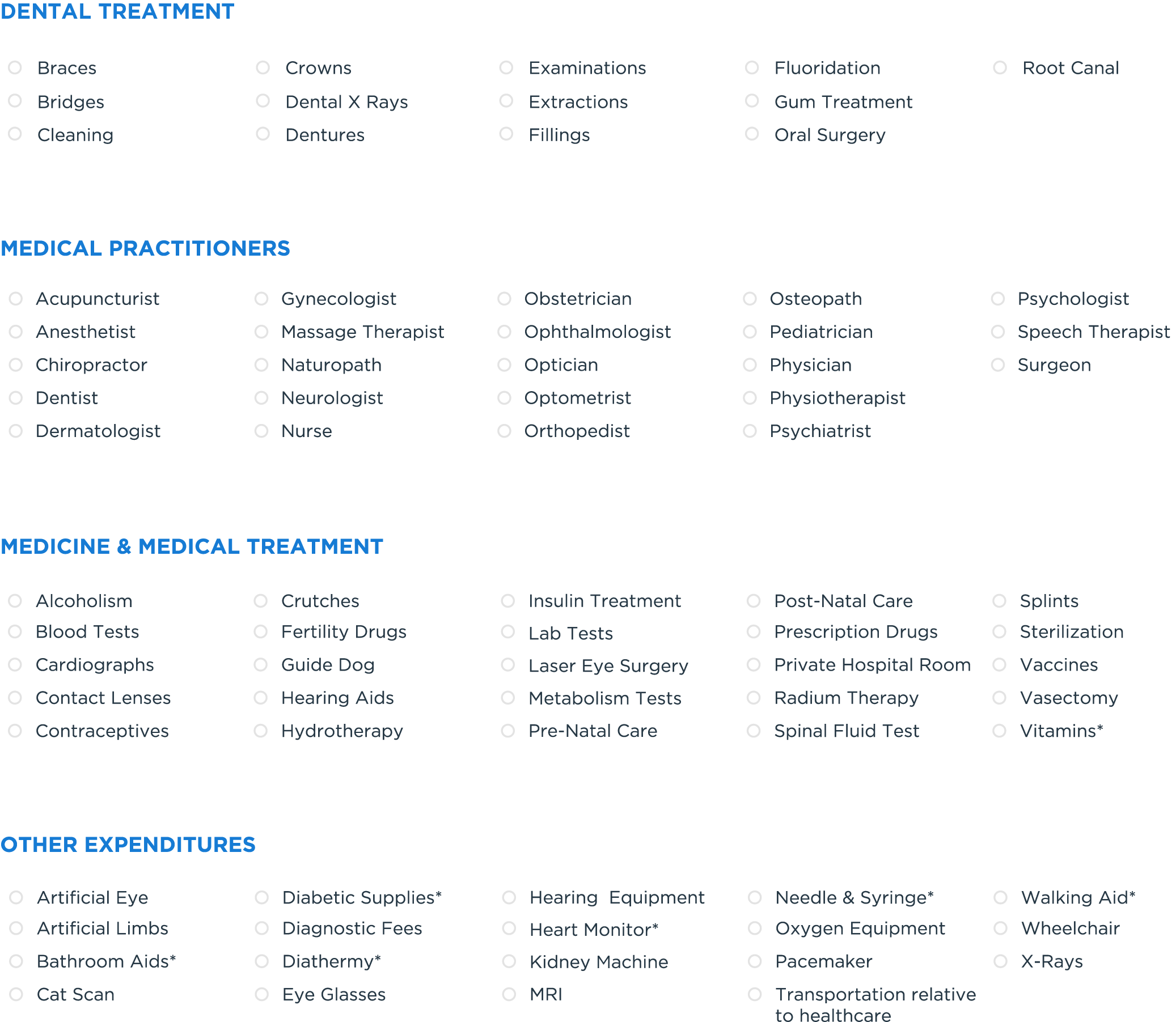

Here are just some of the eligible expenses:

-

* Some expenses require a prescription and may vary by province. We recommend discussions with your tax advisor on how the guidelines impact your particular situation. FlexSave is not available to Unincorporated Sole Proprietors. Wellness benefits are a taxable benefit to employees